On June 15, the Federal Reserve raised interest rates by three-quarters of a percentage point, the largest rate hike in 28 years. It follows increases in March and May, and it’s not over. Another rate hike is expected in July.

The goal of the Fed is to control inflation by driving up costs, which lowers consumer demand. Higher rates make all major purchases, like buying a home, more expensive. For the past couple years, home buyers could borrow at historically low, fixed rates. But for the foreseeable future, those days are gone.

Many consumers will simply put those big-ticket item purchases on hold. But what if you have to buy a house right now?

Especially right now with rates rising, the best loan is one that yields the lowest rate and the lowest payment, and that is typically an ARM loan.

An Adjustable-Rate Mortgage (ARM) Helps Avoid High Interest Rates

To avoid those higher rates, consider an Adjustable-Rate Mortgage (ARM) loan. According to Guardian Savings Bank (GSB) Senior Vice President for Capital Markets, Andrew Murray, “If you need to buy a house now, this is the way to go until we get back to a more reasonable fixed rate.”

Before you flash back to negative connotations attached to ARMs during the recession of 2008, GSB’s Vice President Consumer Direct, Sean Bunevich, asks you to withhold judgement and keep an open mind. The ARM loans of yesterday are not the ARM loans of today:

“Especially right now with rates rising, the best loan is one that yields the lowest rate and the lowest payment, and that is typically an ARM loan,” says Bunevich.

The Difference between a Fixed-Rate Loan and an ARM Loan

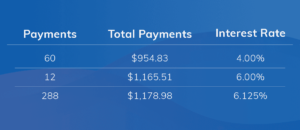

Consider a fixed-rate loan and an ARM loan on a $200,000 mortgage:

The 30-year fixed rate is 6% as of mid-June while the 5-year ARM rate is 4%. The payment difference is $244 per month.* Over the five-year length of the ARM, that’s $14,640 that could’ve been used to pay down the mortgage with the ARM compared to the 30-year fixed, or allocated to a savings account or other debt to give you a better overall financial picture.

Murray points out that depending on the ARM, the rate is fixed for one, three, or five years, generally at lower rates for that initial period, than a fixed-rate mortgage.

“The rate will increase 2% or less each year after the fixed period, but you have the option to refinance, and GSB has very generous refinancing policies that are affordable for our buyers,” he said.

We’re not a big company, and we know our customers. We start communication several months prior to your first rate adjustment to help our customers refinance at a better fixed rate or even relock on a new ARM at little or no cost.

GSB Helps You Find the Best Home Loan Options for Your Needs

According to Bunevich, “We’re not a big company, and we know our customers. We start communication several months prior to your first rate adjustment to help our customers refinance at a better fixed rate or even relock on a new ARM at little or no cost. We find the best option to meet our customers’ needs.”

Even when 30-year fixed rates are low, an ARM can be an advantageous choice for a homebuyer. According to data attributed to the U.S. Census Bureau, only 37% of Americans have lived in their homes for more than 10 years.

“You wouldn’t buy a 30-year plan for your phone or your car,” says Bunevich. “You know your needs will change and the product will change over time. Why should mortgages be any different? Most of our mortgage needs change every 3-5 years, whether that be a new home, large renovation on your current home, or a big purchase or debt consolidation. It doesn’t make sense to spend thousands in interest for a short-term loan.”

A GSB loan officer can walk you through the process now and moving forward as both the market and your needs change.

“We are a community bank – we’re all about building trust and making sure our customers get the best loan to keep them in their home for as long as they want to be there,” says Bunevich. “That might be for a few years or 30 years.”